Serial Acquirer Head-to-Head: $CSU vs. $KPG

1. Comparing KPG to CSU

CSU is widely regarded as one of the best serial acquirers/compounders. It has been acquiring vertical market software companies for over 15 years and made over 100 small acquisitions last year. These small deals (and increasingly larger ones) helped CSU deploy ~$2.5B of capital on acquisitions in 2023. Just like CSU is rolling up the VMS market, Kelly+Partners Group aims to do the same in the SMB audit+tax space. Given that: 1) Lawrence Cunningham (Vice-Chair of CSU’s board) joined KPG’s board in 2022; 2) KPG’s market cap is AUD$350M vs. CAD$85B, it’s worth examining to see whether KPG has the potential to become like CSU. Throughout this write-up, I’ve compared KPG to CSU to determine whether it is a high-quality serial acquirer worthy of investment.

2. KPG Founding Story - The Quest to Build a Great Business

Brett Kelly is a Chartered Accountant turned founder and CEO of Kelly Partners Group since 2006. He graduated from the University of Technology Sydney with an accounting degree and spent nearly 5 years at PwC. He then worked for a year at ValueAdd as an investment banker before being let go. This led to an incredible journey of self-learning and knowledge accumulation. After investment banking, Brett wrote to 80 prominent Australians, including billionaires and former prime ministers. He interviewed 34 individuals and published their insights in a book called Collective Wisdom in 1998. Brett went back to work at various accounting firms and was on the cusp of making partner when the details of his partnership offer were altered. By that point, he was sick of working for accountants and his wife asked why he didn’t just start his own accounting firm. To say that Brett wanted to build a better accounting mousetrap really does not do his ambitions any justice - he wanted to build a great business, period. It just so happened that he had expertise in accounting already and that accounting, when done right, would exhibit qualities of a great business.

Brett studied great businesses (McDonald’s, Walmart, Constellation Software, etc.) as well as past roll-up failures to structure his firm. In my opinion, Brett really understands the power of incentives, just like CSU. He has created alignment by:

Creating a “partner-owner-driver” model: When KPG buys a business, it will purchase a 51% stake, but the existing owner will retain 49%. This is because founder Brett Kelly designed KPG’s entire acquisition model to ensure that its partners retain skin in the game.

This is where there are major differences between CSU and KPG. CSU’s business is about bits and bytes; the software will continue to function even after a takeover and sometimes work better if CSU invests more than the original owner to improve the product. However, KPG depends on trustworthy relationships, some of which may have been built with clients over decades. Past accounting/professional services roll-ups have failed, because this post-acquisition process wasn’t managed well. After the target was acquired, relationship continuity with the customer may have been lost. If the partner was also completely bought out and only kept on as a salaried employee, there would be no incentive for the bought-out partners to work as hard.

Creating a long-term mindset with partners: Partners sign a 10-year agreement when they join KPG. However, if the partner leaves before the 10 year tenure, they receive a significant discount on their equity. This helps weed out sellers that aren’t interested in a long-term partnership.

Being a significant majority shareholder: Brett currently owns 48% of KPG’s shares outstanding and has significant skin in the game.

3. Framework for Analyzing Serial Acquirers

Following Chuck Akre’s 3-legged stool model, I like to break CSU’s formula down into 3 components to further assess potential for value creation: 1) ROIC of the existing business(es), 2) IRR of acquisitions, and 3) amount of cash flows that can be deployed into acquisitions.

ROIC of the existing business: A high ROIC means that the company generates high cash flows which can either be reinvested into the business or used to make acquisitions. The stickier the cash flows the better, ensuring the company can keep deploying capital.

IRR of acquisitions: The higher the IRR, the more value is created by taking all internally generated cash flows and plowing it into M&A. In most cases, we want to see the company making accretive acquisitions instead of paying a dividend or buying back shares.

Amount of cash flows that can be deployed into acquisitions: If the IRR from acquisitions is very high, but targets don’t come up for sale frequently in the industry, or regulations limit more consolidation, this will limit how quickly the company can compound earnings.

Let’s evaluate both CSU and KPG on these 3 components.

4. First Criterion: ROIC of Existing Business

KPG provides accounting and tax services, while CSU is a software provider. On the surface, the two companies operate in different industries, but the most important similarity is that they provide mission-critical services. Approximately 85% of KPG’s revenues come from recurring accounting and tax services, according to the 2018 IPO prospectus. Less than 5% of revenues were derived from audit services, which KPG believes are commoditized.

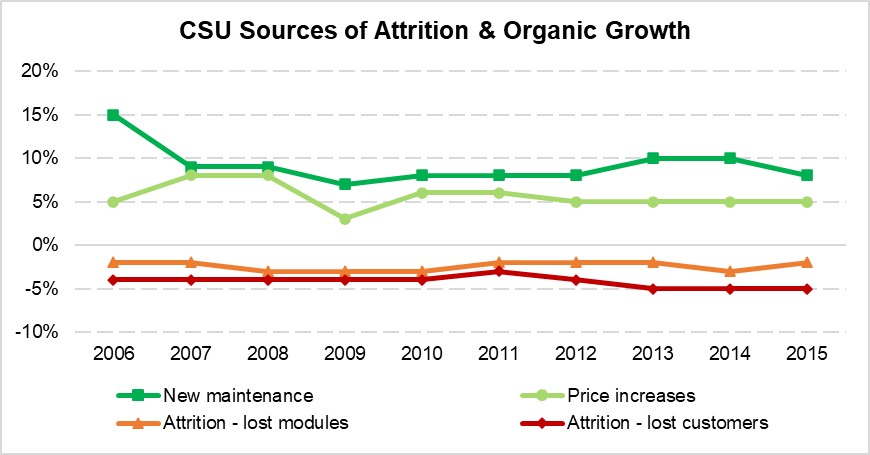

One way to tell that a company offers mission-critical services is to look at the churn rate, which KPG disclosed at 2% annually according to the prospectus. This is incredibly low by accounting industry standards (almost two-thirds of firms reported less than 6 percent of the client base was new each year in 2019). KPG’s churn is even lower than CSU’s churn which averaged 4% for lost customers and 2% for lost software modules from 2006 to 2015. However, CSU more than made up for the churn with 6% average growth from price increases and 9% growth from new software modules.

CSU stopped disclosing detailed attribution of organic growth and only discloses one aggregate organic growth number now. The net result is that KPG has had better organic growth than CSU, but similar growth over the last few years (excludes Altera negative growth).

Now let’s see how that translates into ROIC. You can tell how KPG thinks about the business based on the many useful metrics they provide to investors (e.g. owners’ earnings, ROE and ROIC).

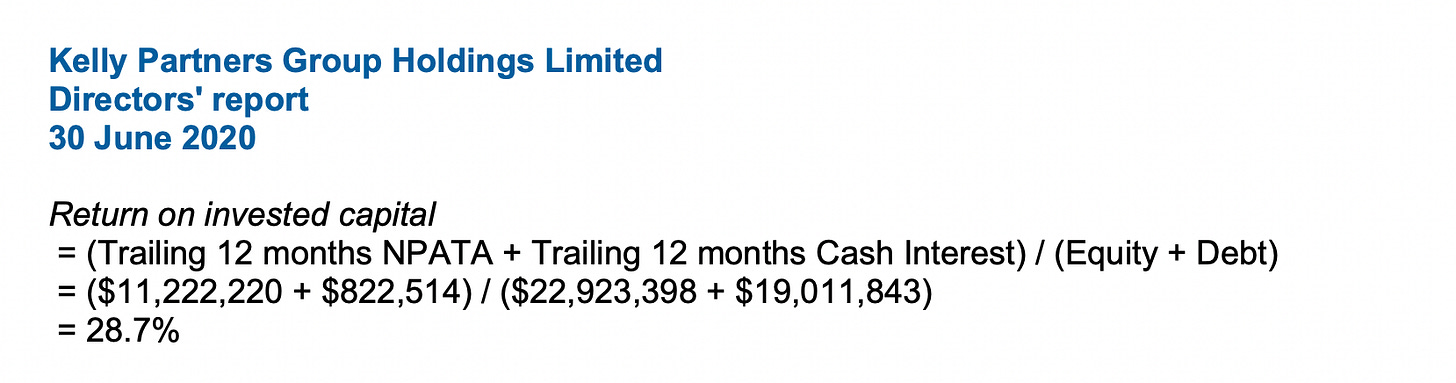

Since its 2017 IPO, KPG has reported an ROIC ranging from the low to high-20s. This compares to return on capital for the entire market of about 9%. KPG reported an ROIC of 28.7% in 2020, which is excellent. Their exact calculation is shown below (the definition is no longer shown post-2020).

I would make one adjustment in the calculation:

Fully tax profits: Since the numerator in KPG’s ROIC calculation is NPATA (net profit after tax before amortization), it is being calculated by deducting reported income tax expense. However, KPG’s annual disclosure states that because of the partnership structure, “actual tax expense is below the applicable tax rate”. We can see the tax expense as a % of net profit was 18.8% in 2022 vs. the statutory tax rate of 30% in Australia. In 2023, KPG reported $1.2M of income tax expense, which equates to 10% of $12.3M of profit before taxes even lower than the 2022 rate. However, the 2023 annual report no longer includes the verbiage that “actual tax expense is below the applicable tax rate”.

My ROIC calculation fully taxes KPG’s EBIT by a 30% tax rate shown below. Despite a clear decline in ROIC over time, KPG’s shares have nearly 10’xed since 2020. It appears that the market believes that there is a long durability in the reinvestment potential at attractive rates.

5. Second Criterion: IRR from Acquisitions

Over the past 4.5 years, KPG disclosed the acquisition details of 26 individual purchases, which we show in the table below. There are a number of critical takeaways from this information:

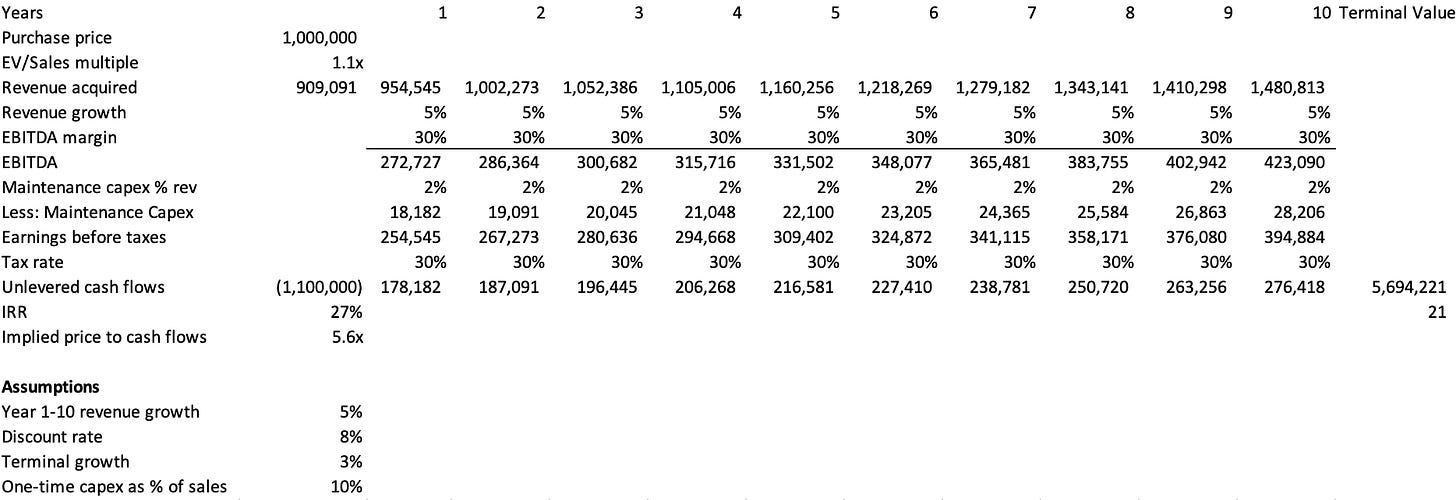

Disciplined deal making: On average, each acquisition was made at just over 1x EV/sales. This is nearly identical to what CSU has paid for acquisitions over the past decade; repeatedly buying businesses at attractive valuations has been key to CSU’s success for a long time. Paying these multiples for a stable, low single-digit growth business results in a 25%+ unlevered IRR as we explain later.

Room for margin expansion: KPG’s targets generated an EBITA margin of 21%, which is exactly identical to the accounting industry average per KPG’s prospectus.

This means that: 1) there is an opportunity to meaningfully increase EBITDA of acquisitions over time and; 2) acquisitions are even cheaper when viewed from a normalized EBITDA margin perspective. Assuming that a company generating a 21% EBITDA margin was acquired for a 4.5x EBITDA headline multiple, this would imply a 3.2x pro-forma multiple assuming the margins immediately increased to 30% (this is purely hypothetical; margin improvement happens over time).

The attractiveness of acquisitions is best demonstrated with an example. If KPG made a $1M acquisition and paid 1.1 EV/sales, this means that it acquired a business generating $900k in revenue. If the target grew at 5% organically over the next 10 years, with a 30% EBITDA margin, that would result in a 27% unlevered IRR.

During KPG’s 2023 AGM, the company pointed out that US accounting services have attracted interest from private equity. A few transactions have occurred at multiples far higher than what KPG has paid (12x, 13x and 15.5x EBITDA for targets ranging in size from $488M to $614M) based on screenshot below. This is not something that shareholders should cheer IMO. As long as the opportunity is attractive, I’d much rather that KPG consolidate the industry without private equity bidding up valuations to more than double what KPG has historically paid. Management says that private equity has not impacted their acquisition cadence or multiples, but this is definitely something to monitor over time.

6. Third Criterion: Reinvestment Runway

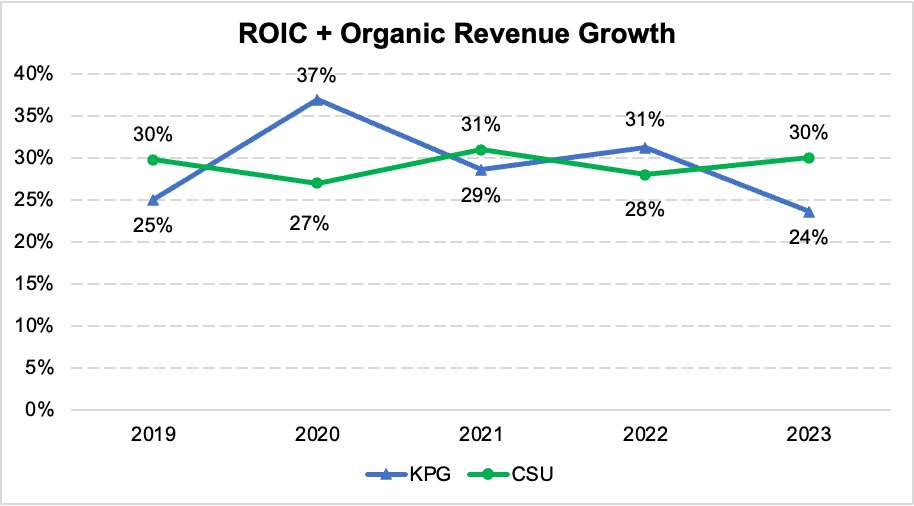

When CSU still published an annual President’s Letter, CEO Mark Leonard liked to disclose his favourite metric, ROIC+organic revenue growth. The metric is useful, but is also missing one key component IMO (% of FCF deployed on acquisitions). Theoretically, if ROIC+organic revenue growth was 30% and the company deployed 100% of FCF on acquisitions at an incremental ROIC of 30%, you’d expect FCF to also grow by 30%. The chart below shows KPG’s vs. CSU’s total ROIC+organic revenue growth. I’d say CSU ranks slightly higher on this metric, but KPG is still an excellent business.

A company that could deploy 100% of their cash flows into acquisitions at a 27% IRR for decades would be a compounding machine. I find it incredibly interesting/amusing that since cutting the dividend in February, KPG’s shares are up more than 50%. This is the exact opposite of what you’d expect to happen to most dividend paying stocks. But, because KPG stated that they planned to use the capital on more acquisitions instead and because acquisitions generate attractive returns, the market has logically applauded this move.

We can see that for the most part (excluding F22), KPG had not been deploying 100% of cash flows on acquisitions over the past 5 years despite the attractiveness of deals.

Contrast KPG’s acquisition spending to CSU’s: the latter has deployed more FCF on acquisitions in the past. This was partially driven by a reduction in CSU’s hurdle rate for larger acquisitions (>$100M) in 2019. But it also relates to the fact that CSU paid out ~6% of FCF in dividends vs. KPG, whose dividends represented 22% of owners’ earnings. (KPG defines owners’ earnings as cash from operating activities less repayment of lease liabilities, and maintenance capex. I consider this to be fairly close to CSU’s FCF definition).

This is a very important consideration when evaluating serial acquirers. These companies compound value by taking their cash flows to make acquisitions, which in turn generate more cash flows. All else equal, a company that can take more of their cash flows and funnel it back into acquisitions will grow faster. A company that reinvested 100% of their profits at a 27% return would have $10.9 in profits at the end of year 10, while a company that reinvested only 50% at the same return would have $3.5 in profits (ignoring organic growth).

The accounting industry in the SMB space is highly fragmented. There are ~37k accounting firms in Australia and in 2023, KPG disclosed 28k acquisition contacts and 115 leads in its universe. After expanding into the US, the company disclosed 49.5k contacts and 193 leads at H1-24. CSU has previously disclosed that it has 40k acquisition opportunities in its database. One of the biggest advantages KPG has over CSU is its much smaller size. KPG has just passed a $100M revenue run-rate or <1% of CSU, which will exceed ~$10B this year.

7. Valuation Not Optically Cheap But Could Still Work

Most of the time, serial acquirers don’t screen cheap optically, whether it is on a P/E, EV/EBITDA, FCF yield basis, especially high-quality ones. I neither want to ignore valuation nor write off a stock completely because of an “expensive” valuation. Chris Mayer likes to look out into the future at how much a company can compound earnings/cash flows and I tend to gravitate towards this approach as well.

I believe KPG is a quality serial acquirer with the opportunity to reinvest cash flows at an attractive ~20% ROIC. The reinvestment runway appears very long (potentially decades+) given the fragmented nature of accounting firms. Brett’s model is also superior in many ways. Owners are aligned, accountability and efficiency result in better margins, and Brett has strong incentives to drive profitable growth over the long term given that he owns close to 50% of shares outstanding.

At the same time, investors have been very enthusiastic about KPG. The shares have appreciated 60% YTD with a market cap of $350M. KPG reported $4.4M of owners’ earnings (CFO less maintenance capex less lease liabilities) in H1-24, which represents an estimated ~40x multiple on NTM cash flows. At the risk of stating the obvious, this is not a stock that you would buy and expect to flip for a quick profit (even though that’s exactly what you could have done over the past 5 years aside from 2022). Like most serial acquirers, you probably don’t want to invest unless there’s a long runway for growth and if there is, you want to hang on while they execute on that runway.

Here are some ways to think about valuation/potential return. Owner’s earnings compounded by 23% from F19 to F22. This was while KPG was still paying dividends and only 30% of owners’ earnings were reinvested into acquisitions from F19 to F21. Over the next five years, I think that owners’ earnings should be able to compound by 20%+ if most or all of owners’ earnings is spent on accretive acquisitions and 5% organic growth is maintained.

If the multiple contracts from 40x to 35x or 30x, we still get a 16% and 12% IRR, respectively. I’m not saying that I expect multiple contraction but prefer not to underwrite expansion/maintenance if the multiple is already at a high starting level. If owners’ earnings compounds at 25% instead of 20%, IRR would be 21% and 17% with multiple contraction to 35x and 30x. Charlie Munger has said that “over the long term, it's hard for a stock to earn a much better return than the business which underlies it earns”. His original intention was to convey that even buying and holding a very inexpensive investment is unlikely to result in long-term spectacular returns if the business is just mediocre. However, if we invert, the opposite is also true. If we buy a high-quality business that generates 20%+ ROIC for a decade+, it is hard to earn an IRR that is too different from 20% unless an investor materially overpays. And while a 40x FCF multiple would not screen as cheap for any value investor, it could still be worth it if the company compounds for a long time.

8. Closing Thoughts

Thank you for reading! My DMs are open (@phoenixcapital0 on X) and I’m open to critical feedback and discussion. I’m interested in further analyzing: 1) how easy it is for private equity to copy KPG, similar to how they’ve done with CSU (Arcadea Capital has close to C$700M in committed capital for VMS acquisitions as of July, Valsoft closed C$229M in financing for VMS acquisitions in January); 2) how KPG will expand in the U.S.